Chocolate spread taste’s yummy, but what about spread in forex? Let’s break it down.

Forex brokers quote two prices for a currency pair, the bid and the ask price. A bid is a price at which you sell the base currency and ask is the price at which you buy the base currency.

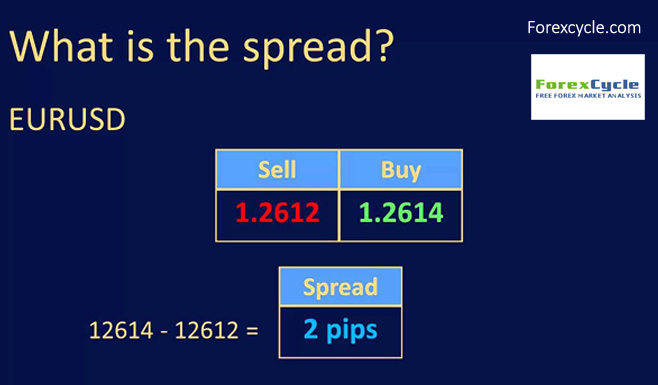

The difference between the bid/ask price is known as the spread in forex.

Brokers who offer no commission make money from the spread. Let’s say you want to buy a currency pair and immediately want to sell it. You will notice that the rate at which you bought the currency pair is higher than your selling rate. This difference in the rate is known as the spread.

Confused? Let’s make it simple.

You bought a laptop at $1000. Now you want to sell it. You list the laptop on eBay for an asking price of $800. Someone bought the laptop. In this scenario, the price difference of $200 is the spread.

How is spread calculated?

Spread in forex is measured in pips, which is the smallest unit of price movement of a currency pair. One pip is equal to 0.0001.

For this example, we’ll use the EUR/USD pair.

Let’s say the EUR is worth 1.1152 times the USD. You want to buy the pair. The asking price won’t be 1.1152. It will be higher, like 1.1154 and if you want to sell EUR/USD, then the price can be 1.1150.

Notice the difference between the prices. In case of buying, the spread is 1.1154 – 1.1152 = 2pips, and in terms of selling, the spread is 1.1154 – 1.1150 = 4pips.

Types of forex spreads

In forex, there are two types of spreads, fixed and the floating spread.

1. Fixed spread

A fixed spread does not depend on the current market situation. By using fixed spreads, the forex trader knows in advance how much he/she will need to pay to open a position for one of the currency pairs.

2. Floating spread

A floating spread value tends to change and depends on the market conditions. Most pairs in the forex market are set for floating spreads.

Here’s how these floating spreads work.

For this example, we are using the EUR/USD.

We found that the fixed spread is 2 pips. By trading on such terms, we are confident that the spread will not expand, even if the level of volatility in the market increases.

However, when viewed from the opposite side, a floating spread on EUR/USD fluctuates, and from time to time, its value may be lower than the value of the fixed spread.

With increasing volatility, the floating spread can reach to more than 8-10 pips. However, with lower levels of volatility, the floating spread also decreases and may be equal to a tenth of one pip.

Which spread should you choose?

For those traders who are focused on long-term trading, floating spreads are more profitable since they can choose the moments with the least volatility and get the smallest possible forex spread.

Fixed spreads are ideal for beginners as the trader will be able to avoid excessively high spreads during high market activity.

References: The definitions and calculations basics of spreads have been taken from the online Wikipedia’s article and FXCC’s article What is spread in Forex Trading.