USDCAD Analysis.

USDCAD remains in uptrend from 1.0182 (Sep 19 low), the price action from 1.0496 could be treated as consolidation of the uptrend. Key support is located at the lower line of the price channel on 4-hour chart, as long as the channel support holds, the uptrend could be expected to resume, and one more rise towards 1.0700 is still possible. On the downside, a clear break below the channel support will indicate that the uptrend from 1.0182 had completed at 1.0525 already, then the following downward movement could bring price to 1.3000 zone.

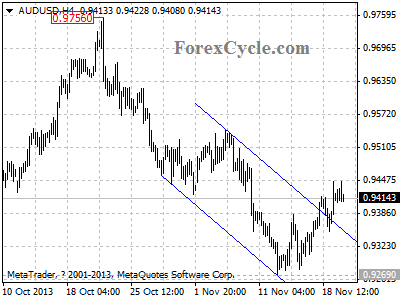

AUDUSD Analysis.

AUDUSD breaks above the upper line of the price channel on 4-hour chart, suggesting that the downtrend from 0.9756 had completed at 0.9269 already. The pair is now in uptrend, further rise could be expected, and next target would be at 0.9550 area. Support is at 0.9350, as long as this level holds, the uptrend will continue.

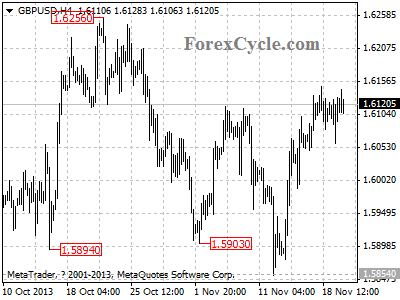

GBPUSD Analysis.

GBPUSD’s rise from 1.5854 extends to as high as 1.6148. Further rise to test 1.6259 resistance is possible, a break above this level will signal resumption of the uptrend from 1.4813 (Jul 9 low), then the target would be at 1.7000 area. On the other side, a breakdown below 1.5854 support will confirm that the uptrend from 1.4813 had completed at 1.6259 already, then the following downward movement could bring price to 1.4500 zone.

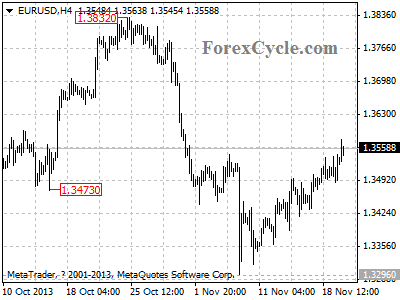

EURUSD Analysis.

EURUSD continues its upward movement from 1.3296, and the rise extends to as high as 1.3578. Support is now at 1.3485, as long as this level holds, the uptrend could be expected to continue, and next target would be at 1.3650 area. On the downside, a breakdown below 1.3485 will indicate that the upward movement from 1.3296 has completed, then the following downward movement could bring price back to 1.3000 zone.

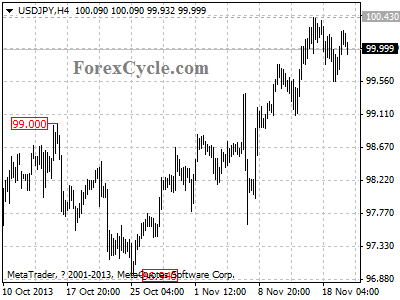

USDJPY Analysis.

No changed in our view, USDJPY remains in uptrend from 96.94, the fall from 100.43 could be treated as consolidation of the uptrend. Key support is at 99.10, as long as this level holds, the uptrend could be expected to resume, and one more rise towards 101.00 is still possible after consolidation. On the downside, a breakdown below 99.10 support will indicate that the uptrend from 96.94 had completed at 100.43 already, then the following downward movement could bring price to 97.00 area.

USDCHF Analysis.

USDCHF continues its downward movement from 0.9249, and the fall extends to as low as 0.9079. Further decline could be expected, and next target would be at 0.9050 area. Resistance is at 0.9145, only break above this level could signal completion of the downtrend.